With each passing day, the importance of insurance is increasing. But so is the competition between insurance agencies. Thousands of insurance agencies have sprung up over time. But only a handful of them survived. The reason behind it? Underestimating the importance of insurance agency lead generation.

In this article, we’ll navigate through the ever-evolving landscape of lead generation. From tried-and-true traditional methods to cutting-edge digital tactics, we’ll explore a wide array of techniques designed to attract, engage, and convert leads into loyal clients.

Join us as we uncover practical strategies, share expert insights, and provide real-world examples that will teach you all you need to know about insurance agency lead generation to thrive in today’s competitive market.

Lead generation is an ongoing process that seeks to attract and convert targeted web visitors into qualified prospects. Lead generation as a process requires many tools, marketing services, and an investment of time and money. The ultimate goal is to increase sales. It can be done both online and offline. Technology has taken a leading role and a major number of people are doing everything online. That is why there are better scopes on online lead generation than offline.

Lead generation is a very important aspect of any business. Without lead generation, the business may find difficulties in increasing its sales and expanding its business. When it comes to insurance companies, the importance doubles.

Finding new insurance clients isn’t always easy, even for the most seasoned agents. And that’s why lead generation is so important. Insurance Agency lead generation is critical in the industry, as it ensures a healthy pipeline of potential customers. It is the key to having a thriving insurance business..

When you carefully and intentionally create each step of the journey, you build a streamlined pipeline that delivers the information your leads need at the precise times they need it. According to market research, about 69% of consumers search online for the best options before finalizing an insurance deal.

Generating leads is a challenge for any business. This is especially true for insurance companies. Insurance lead generation requires more effort and finesse as the potential client or customer needs to be convinced to accept a very long-term offer. This is where things can get difficult.

Here are some of the places insurance companies may need to work on to ensure effective lead generation:

If you have a solid system in place, you’ll be less likely to neglect following up with your prospects. Get in the habit of following up on leads as soon as you can. You must know that voicemails and emails are an acceptable first contact where you can introduce yourself and share your contact info. Also, letting the client know you still value their business after the sale can do wonders the next time you contact them for renewal.

Open-ended questions that start with “wh” work well to know about the customer’s journey and their needs. For the listening sales approach to work, you have to learn how to ask a question that tells you more about the prospect’s needs, priorities, and sales objections.

Though sales play an important role in determining the business ROI, it might work as a con for customer retention in case you are too pushy and take an aggressive approach. Remember, you’re still building that rapport and common ground that lead to the prospect trusting the agent. Instead, let the prospect do most of the talking and continue to ask questions about any objections you hear or sense.

It is indeed hard to work hard continuously, but that’s how you stay ahead of the crowd and can compete. Nowadays, the market shifts every day, and when it changes, you need to change as well. If you’re an independent agent, diversify your product offerings. Opportunities to meet new needs for current clients in other areas will come up.

Once you spend the time building a rapport and trust and following up with them regularly, cross-selling becomes a natural next step for your business. Suppose you’re not an independent agent, network with other professionals. You may be able to take turns trading referrals when you can’t supply the product the prospect needs.

The insurance business is all about building trust and strengthening bonding – that is what helps to retain customers. Instead, if you get into the sales right away, rejecting the primary step, you might end up losing customers. There are always things that bind strangers together. Your sales will improve when you find such a topic for each prospect, make a note of it, and open every sales conversation with it.

Did you know 74% of customers research insurance policies online, but due to the complexity of the purchase, only 25% end up buying them online? And the rest prefer to speak to a live agent or walk into the insurance offices. So where’s the deficit? – a good insurance agency lead generation procedure.

Unlike B2B lead generation, which involves many buyers and a lengthy sales process, insurance agencies just need to connect with one or two buyers to close a deal.

It has been found that about 69% of consumers search online for the best options before finalizing an insurance deal. It shows the importance of productive insurance agency lead generation and the need to digitize a brand’s online presence.

So in this article, we have discussed the importance of a well-planned lead generation plan for an insurance agency. Now here are some tips to help you create the best lead generation strategy best suited for your business;

Volunteering is a good way to establish a reputation as a caring and committed member of your community. But you can also show off your insurance industry by hosting insurance seminars for small business owners, assisting clients’ friends or relatives when appropriate, or advising local charities on their insurance purchases.

By launching a referral program, you can make more of your leads than it is now – but not for free. Throw in incentives like lottery tickets, gift cards, and movie tickets to make referrals more exciting for your clients.

Networking is all-important to your business. Your city or town is likely to have networking groups where professionals from different industries meet regularly to socialize, swap strategies, and refer business to each other. Find these groups and get involved.

Most people need insurance at some point; the trick is to be top-of-mind when that point arrives. One trick to achieve this success is to provide your customers with wallet-sized referral cards that they can carry with them. Include contact information for local emergency providers and other key resources, along with the phone number for your office.

Video marketing has become vital to digital success as video consumption has risen every year for several years. Videos allow you to present information and resources more engagingly. Offer tips, insights, and answers to common marketplace questions, and embed calls-to-action that drive viewers to your website for more information on your insurance products.

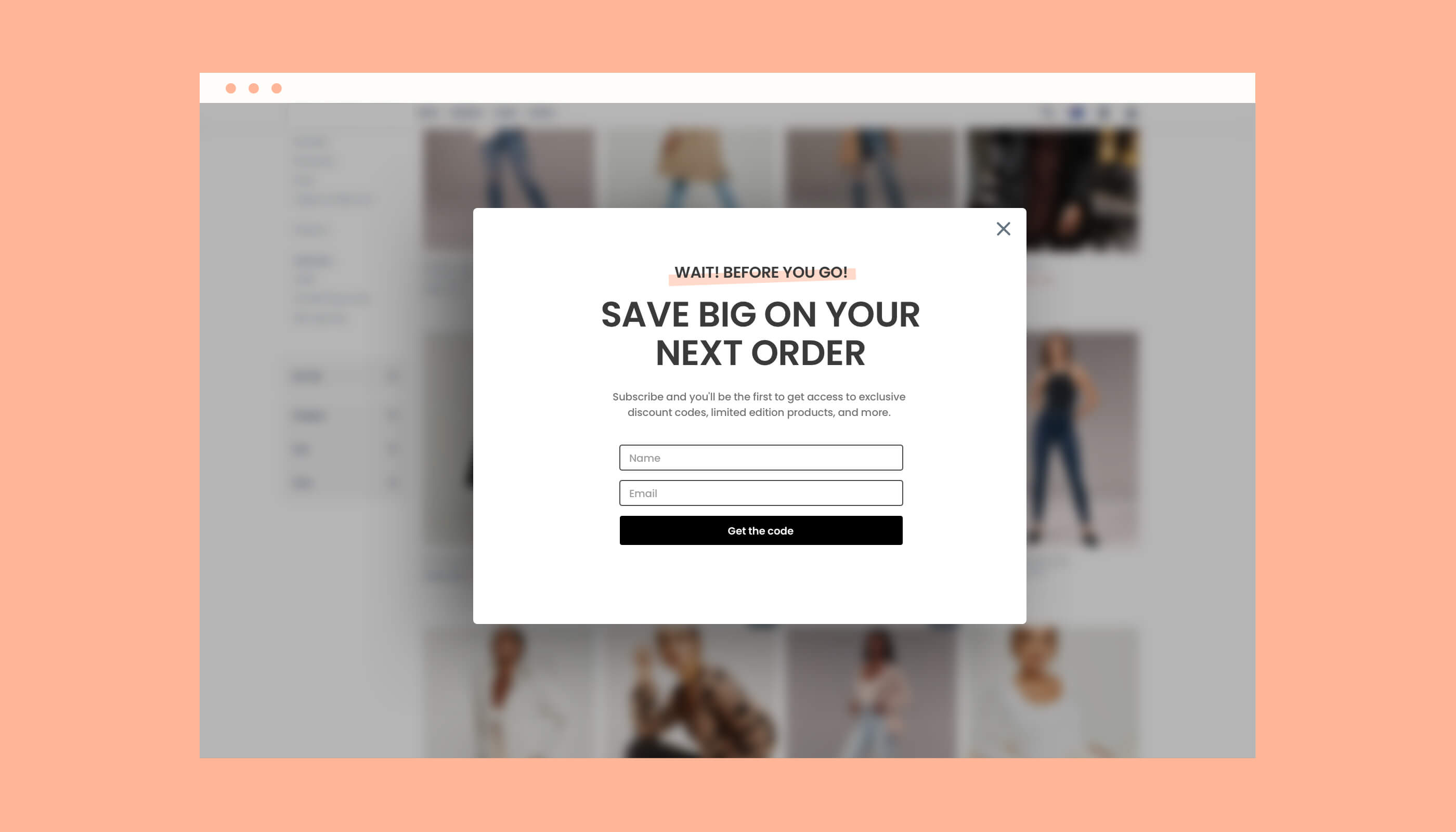

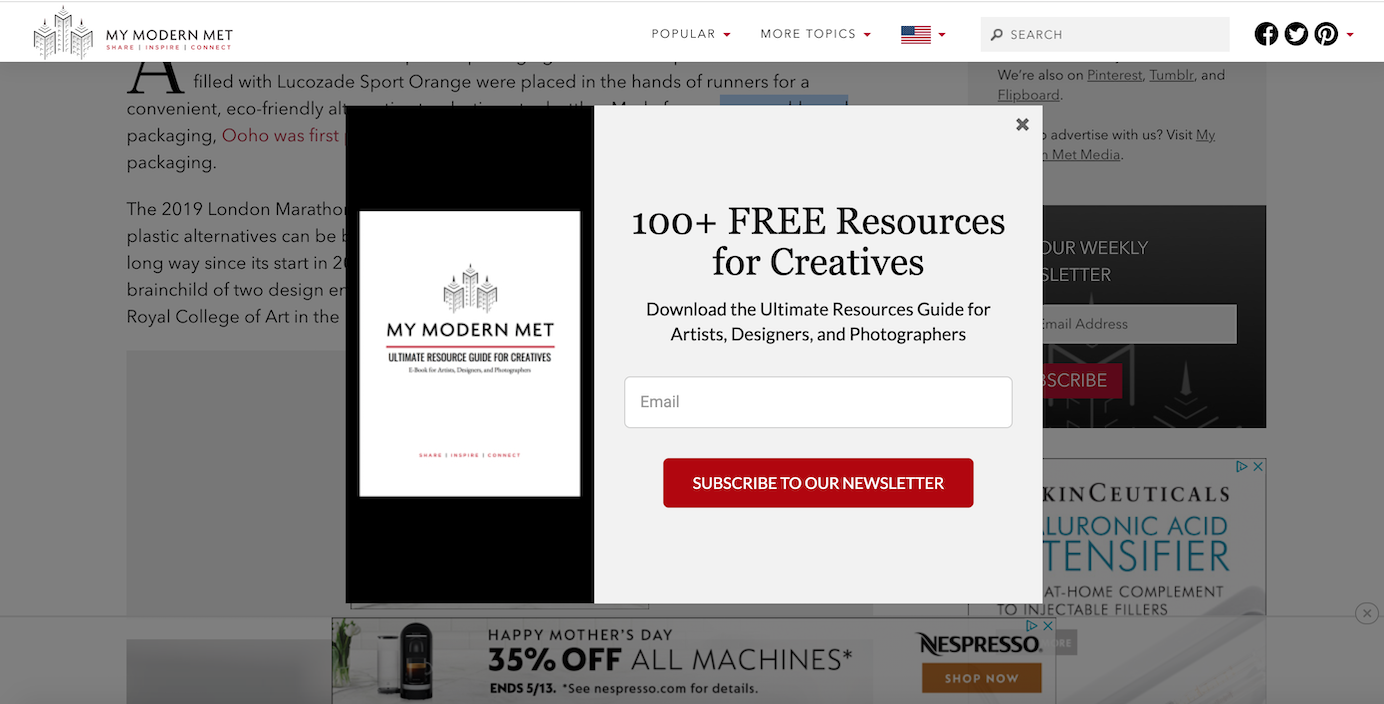

When a user visits your website, you want them to give you their email address, phone number, or other details. If you offer something valuable in return, they are more likely to give you their personal information. That’s the concept behind lead capture forms. Provide your customers with a report, case study, infographic, webinar, or anything they may be interested in. Let them know about what you have to offer via a lead capture form.

Think of long-form questions that your buyer personas are likely to search for. You can leverage advanced SEO tools to understand popular search trends. When you are creating content for your blog, you need to keep this in mind. If you want your post to make it to the top of SERPs, you’ll need to make sure that it answers questions that users might have.

The target audience for LinkedIn is business professionals and decision-makers for businesses. For B2B lead generation, this is the segment that matters the most. After all, they call the shots when it comes to closing deals. By increasing your visibility on the platform, you are likely to reach out to the right target audience.

Proactive insurance agency lead generation is critical to prevent the erosion of your client base and to grow your business year after year. However, with new technologies and marketing channels available at your fingertips, it’s possible to generate more leads without exhausting all your time. Keep in mind that using just one strategy won’t take you too far. Use a mix of the above-mentioned tactics to get more qualified leads and grow your business.

, September 24, 2021, Team LimeCall

Top rated callback automation platform that connects your website visitors to your team within 20 seconds through phone callback and whatsapp driving upto 40% more conversions.

Learn more